The Importance of Having an Estate Plan

Why Choose Us

We are knowledgeable fast cost effective

Expertise and Knowledge

Our team has specialized knowledge and experience in estate laws and regulations, ensuring your plan is legally sound and up-to-date.

Personalized Planning

We tailor estate plans to your unique needs and circumstances, providing customized solutions that reflect your specific goals and family dynamics.

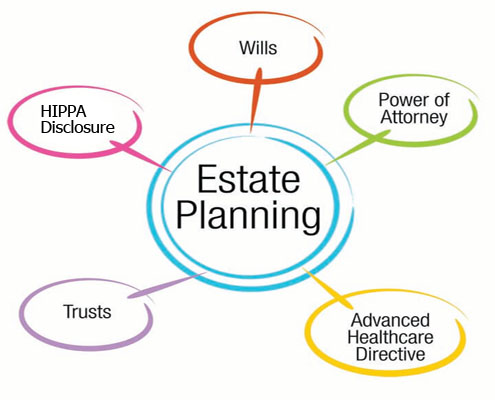

Comprehensive Approach

We offers a holistic approach, integrating various aspects like wills, trusts, powers of attorney, and healthcare directives into a cohesive plan.

Tax Efficiency

Our experts help minimize estate and inheritance taxes, ensuring that more of your assets are preserved for your beneficiaries.

Avoiding Probate

We structure your estate to avoid or minimize the probate process, saving time and reducing stress for your loved ones.

Flexibility and Adaptability

Our estate plans are designed to remain flexible and can be updated as your life circumstances and goals change over time.

Our Services

Additional Services

$500

Per property.

* Notarization and Recording Fees Included!